Insurance Tips, Stories and Video Articles

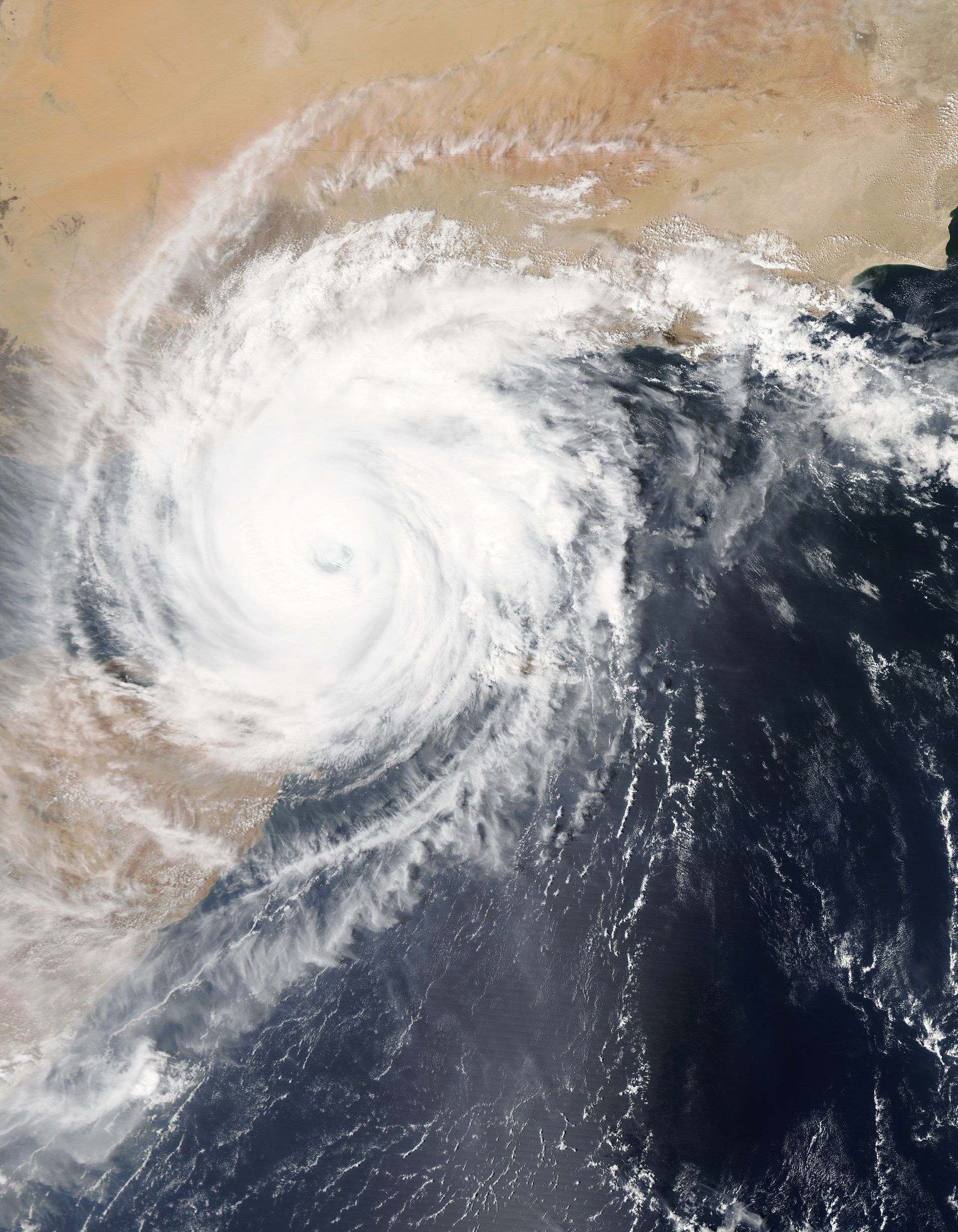

Sean: If you don't mind we actually got some client questions. Some of our customers have sent through some questions and you can answer them for me? Bradley: Absolutely. Sean: All right, first question is what happens if my claim is greater than the insured amount on my policy? Bradley: Well so you're covered for up to the insured amount, so if your sum in short is x hundred thousand dollars, that's that's the limit of your claim, but many of our benefits are in excess of that, so if in the unfortunate event you have to demolish the house well that amount for the demolition is covered in excess of up to a little in excess of that. So you nominate, you should the advice we would give is, you should always put the right sum, in short on the amount that it would take to rebuild your home plus those costs, it's always good to have the right sum insured so there's no surprises. When a claim occurs it's very rare claims of that that size occurs, but when it does, it's critical you have the right insurance. Sean: I think a lot of time there, our clients get mixed up with the difference between your replacement sum and your purchase price. Bradley: Exactly right Sean. Now the purchase price of course, includes the value of the land, and nowadays you know land the price of land is quite a significant component, but nonetheless what we would advise people to do is, look at how much they pay talk to a builder, there are online some insured calculators that we can point people to, so go to our website and access a process and key in all your details and that will estimate the price that you should insure your house for. It might take you 15 minutes or so to do it but it's time well spent to make sure that you're at short the right amount because as you increase your some insured the price to increase um is very very low compared to the the bottom end of something short, so as you increase it gets cheaper and cheaper to ensure that additional. Sean: Yeah because this usually is a person's greatest investment and greatest purchase is their home. Bradley: It is, I mean for all of us it's the biggest thing that we own um it's the thing we worry most about and the thing that if we lost it and we weren't fully insured it's it's heartbreaking. When that happens it's absolutely heartbreaking. We would much prefer to be putting people back where they were with full cover and making sure that they're fully covered at all times. Sean: Yeah we have a client of ours who's most unfortunate. I mean the chances of having a total fire loss of your home is rare, having a two total losses is unheard of. We have a client who's had two total losses from the fire and he was big premiums but never complained about the price when it came to claim time. Bradley: Absolutely and look it does happen, as we say you know it's probably a very small percentage, but it does happen to people, um and whether it be fire whether it be flood, or whether it be the cyclone situation. Yes it's rare, but you know we all want to be able to sleep well at night knowing whatever happens we're fully covered. I think that's what insurance should be providing is the ability to make sure you sleep at night knowing you're fully covered and your claims are going to be paid correctly and promptly.

Sean: Are we looking to move into motor vehicle insurance at all? Bradley: Not at this stage. I think motor insurance is something that's a very well serviced market in regional Queensland it hasn't faced the same sort of cost pressures that we've seen on home and contents and strata and home unit insurance, so at this stage no we're not looking at it. I mean, we get the odd inquiry but it's not something that people seem um seem keen for us to do at this particular stage. I wouldn't rule it out down the track, but at the moment we're concentrating on doing what we said we would do, and that's saving people significant amounts on their premium for home and contents and strata.

Sean: Hi everyone, Sean from Lords Insurance thanks for tuning in. One of the hot topics in North Queensland the last few years have been the increased premiums in home and contents and strata. T hey've been quite large and quite astronomical, but one of the insurers that's helping us reduce premiums is Sure insurance. I'm happy to say that we have the Manager Director of Sure Insurance here today, Mr Bradley Heath. Bradley thank you for being here. Bradley: No problem, thank you Sean. Sean: Now Brad a lot of people would know about Sure Insurance and what you do and but a lot of people in the community wouldn't know what Sure is, would you mind telling us a little bit about Sure and how it started? Bradley: Oh a bsolutely. So Sure is an organization we've set up to write insurance in regional Queensland, so home and contents and strata insurance. We were formed around about four years ago and have been operating now for nearly two years. W e're an organization that does all the product all the pricing all the claims so when you deal with Sure, you're dealing with the entirety of the process we're backed by a worldwide insurer called Liberty Insurance who's licensed in A ustralia and they're one of the world's biggest mutuals in one of the world, one of the biggest insurers in the US, so we've got the right backing, we've got the right processes, and we're an organisation that's dedicated to one thing, and that's doing North Queensland insurance. Sean: S o you don't do Australia-wide do you? Bradley: We don't do Australia-wide, we only do from Bundaberg north, all the way up to the Cape and out to the border, so that's our that's our specialty area, that's what we've been set up to do, and that's what we're very much focussed on. We want to specialize in that, we want to make sure that's the area we're providing the best service to and provide the best service to the people of regional Queensland. Sean: Is that for any particular reason? Bradley: I mean we know the people in regional Queensland have been hit very hard by premium increases over the last few years and we thought we could do something better for them and so far we've been able to do that on average we're saving people 35% off their premiums that's one home and contents and sometimes more than that on the strata side of it as well, so this is about doing specialist work for the people of regional Queensland and providing them with a viable alternative. Sean: A lot of questions I get asked from consumers and customers is that, "why are we paying so much in North Queensland compared to say people down in Brisbane, down in Melbourne you know further afield when they seem to be having a lot of natural disasters so they're having you know cyclones they're having floods hail storms yet we seem to be getting hit with larger premiums up here any reason for that y ou think? Bradley: Well I think that's been the mystery to so many people in North Queensland as to why they're paying when they're not the ones having events and I think it's a reasonable question t o ask. I mean i think people in in regional Q ueensland and North Queensland they know that they're in a cyclone area they they live that they breathe that so they understand that the premiums i think are going to be a little bit higher but what they don't understand and it's the correct question and quite rightly so, it's why it's so much higher than other areas. A nd that's what Sure was formed to address and and fix that problem and that's that's what we're very much dedicated to doing. Sean: A nd I guess one of the questions I also get asked about Sure, is now they've come into the market, are you here to stay? Bradley: Look, we're here to stay. We've got long-term backing from our from our backers, we've taken out long-term leases on our office accommodation. We're here for the long term so this isn't a matter of when a cyclone happens we're going to cut and run we're here for the long term. W e know and our backers know, that eventually there will be there will be a large claim like a cyclone, like a flood that's what we're in the business of doing, that's what we're set up to manage and our backers and ourselves know very much that's the reality of insuring you, so we're here to stay, we're here for the long term and we've got plenty of capacity to continue to write this business and write more market share. Sean: Well that's probably t he number one question I get asked is you know, they've come along into the market, now what are they like paying claims, are they going to pay out, are they going to cover things you think like bushfires - the catastrophes if they hit you're going to be here and you're going to be able to do that for them? Bradley: Look that's the question I would ask if i was a policy holder. That's great, it's a g ood premium but are they going to be here to pay? T he claims are they going to pay the claims are they going to be fair and that's something Sure set up and everyone might notice our logo is Sure I nsurance but fair. This is very much about doing the right things when it counts, and that's paying the claims. We're not afraid of paying claims we're experienced in this, we have the right builders we have the right the right loss adjusters and we have the right people to handle it and, if people want to use their own builder in that situation, we're perfectly happy to look at that and if it's the right price we will definitely let people use their own builders, and in fact we encourage it. S o yeah we're here to pay the claims, we've done it before, we know how to do it, and we know that this is the most important thing for people in North Queensland, will they pay the claims, then will they pay them fairly and that's the right question and I 'm here to say that's what we're set up to do. Sean: G reat, okay another question too, around Strata. In strata complexes is the fact that mitigation is a big part of Sure's motto and mantra and that you do say that with mitigation you can reduce your premium so what kind of mitigation factors are you looking at? Bradley: There's lots of mitigation people can do. So basic maintenance is always a good one, so keeping the place maintained and really simple things like keeping your gutters clean, keeping the outside the trees trimmed to stop that sort of damage caused by that but other things that are really topical and burning issues for many units is the issue of flexi hoses. Sean: S o i understand that the number one damage of water damage claims is flexi hoses? Bradley: L ook it's a big issue for the industry and it's a big issue for people when they let go. U nfortunately when flexi hoses let go and these are the pipes underneath people's sinks, when they do let go they tend to silently flood the area and often it happens at night and when people are away. For various reasons so this is quite a distressing claim for people it causes widespread damage across carpet across cabinetry across skirting boards and you know it's a very invasive sort of claim, so what we encourage people to do is get those flexi hoses checked every 12 to 22 years and prevent that client happening. It'll save you an excess and it'll save you money. Sean: A nd your premiums on a whole across the board are quite competitive and I guess another question that people ask go well are they because they're so cheap or competitive is that because they're not offering the same covers? Bradley: So we we cover all the things that people you know genuinely need. S o we cover flood automatically, we cover storm surge, we cover cyclone, we cover all of those things that matter and we're constantly upgrading the product to make sure that it's meeting the needs of the people and meeting the needs when it's compared to our to our competitors as well, so it's something that we want to cover as much as we can, the common things people need and we don't think there's many things in there if at all that people wouldn't be covered for. In fact some of the things we've got are in excess of what our competitors cover as well this is a product designed specifically for regional Queensland it's not a national australian product that's been adapted to Queensland, this is a product that was designed for the people of regional Queensland. Sean: G ood, and what about your future vision for for S ure, where do you be going the next few years? Bradley: Y eah so we want to continue writing business we've still um you know we've still got a plenty of market market share available to us we want to continue to save more people more money and of course the more people we write insurance for the cheaper we'll get overall we're increasing the limits that we can write for our body corporate for our home unit insurance and we we want to write more of that business people there because we know it's a critical area where people are paying huge premiums and in many cases are completely unaffordable for people, so this is about doing more of the same and continuing to do it better and better and better as we go along. Sean: W ell thanks Bradley, that's been very helpful and thanks for your chat today and we're happy that Sure's in North Queensland it's been a very good helpful insurance coverage for our clients and um will be so thank you for your time today. Bradley: Thanks very much Sean thanks for all the great work that Lords do as well, you've been great supporters of us and hopefully we're doing the right thing by your clients as well and we'll continue to do so thank you yeah thank you. Sean: Well that's all for now, thanks thanks for watching and we will bring you another insurance video shortly.

Sean: Another question from clients - are boundary fences covered and who pays when they are damaged in cyclones? Bradley: Yeah, so fences are often one of the big things that are affected by cyclones and storms, you know things are often blown down for obvious reasons, um so you're covered in your policy up to a kilometre of fencing, so that's a thousand meters of fencing for your property and that that's that's you know cover enough for the average person, particularly where there's not a farm involved. So from our viewpoint that gives you plenty of cover for that situation.

Will my premiums increase next year if i make a claim? Now not in in the case of Sure, because we don't have a no claim bonus situation, so if you make a claim now, your premium won't increase because of that. Your sum insured might increase next year and you know you might want to increase your some insurance that may increase the premium as well, but the renewal process we're going through right now for the vast majority of our policyholders, the renewals are reducing because we've reduced our prices in the last couple of years. It's very rare, it is very rare in regional Queensland, in fact, we've had customers ring us and question whether the number was correct and in some cases have said is this the monthly price or the yearly price? But no, we you know at Sure was set up to provide people in regional Queensland and North Queensland with a better option. That's what we're doing that's what we're committed to and that's what we're committed to on the long term